List of Content

- Why Customer Lifetime Value Matters and How CRM Fits In?

- Strategy 1: Segmenting Customers for Targeted Upsells

- Strategy 2: Personalising Offers to Boost Repeat Purchases

- Strategy 3: Predicting and Preventing Churn

- Strategy 4: Rewarding Loyalty to Lock In Long-Term Value

- Measuring Success and Optimising Customer Lifetime Value

- The Importance of a CRM Consultant in Maximising Customer Lifetime Value

- Top Tips for Using CRM to Enhance Customer Lifetime Value

- Conclusion

Introduction: Unlocking the Power of Customer Lifetime Value

Customer relationship management (CRM) systems are the linchpin in this strategy. CRMs empower businesses to nurture relationships that boost retention and revenue by centralising data on purchase history, preferences, and interactions. Research from Bain & Company underscores this: retaining customers is not just cheaper—costing 5-25 times less than acquiring new ones—but also amplifies profits significantlyThe Value of Keeping the Right Customers. In this article, we’ll explore four proven strategies to maximise customer lifetime value using CRM, offering actionable steps tailored for businesses of all sizes across the UK.

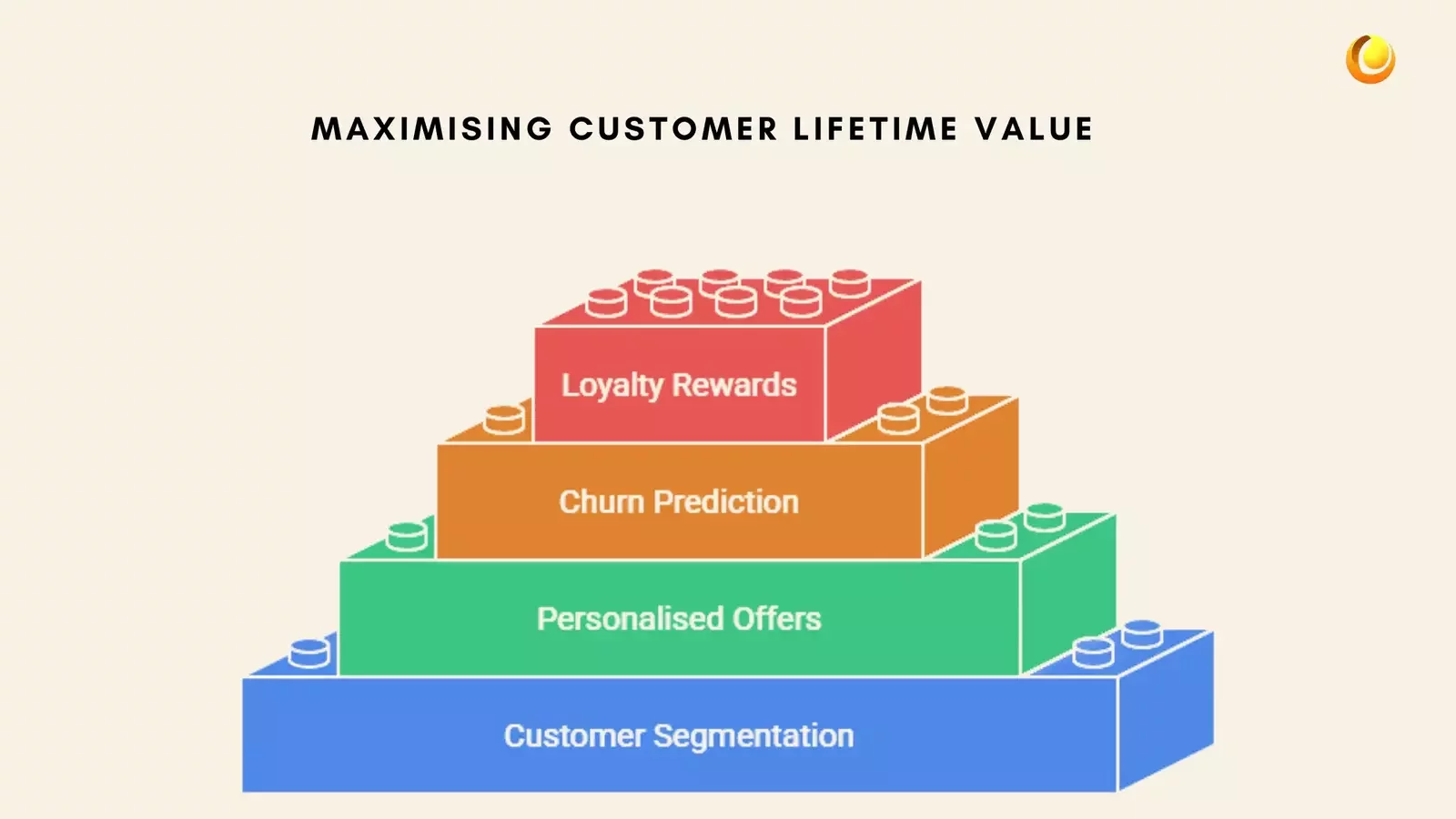

Why Customer Lifetime Value Matters and How CRM Fits In?

Customer lifetime value (CLV) is the heartbeat of sustainable growth. For firms—whether you’re a Manchester-based retailer, a London tech startup, or a Birmingham consultancy—focusing on CLV means prioritising long-term profitability over short-term wins. The math is compelling: acquiring new customers can drain budgets, especially with rising digital advertising costs in 2025, whereas keeping existing ones is a fraction of the expense. Understand Customer Acquisition Costs vs. Retention Costs.

CRMs are the engine driving this shift. They transform raw data—think order frequencies, product preferences, or support queries—into actionable insights. For instance, a CRM might reveal that 20% of your customers account for 80% of your revenue, a classic Pareto principle in action. By identifying these high-value clients, you can tailor strategies to enhance their CLV, ensuring they stay loyal and spend more. Let’s dive into how this works with four key approaches.

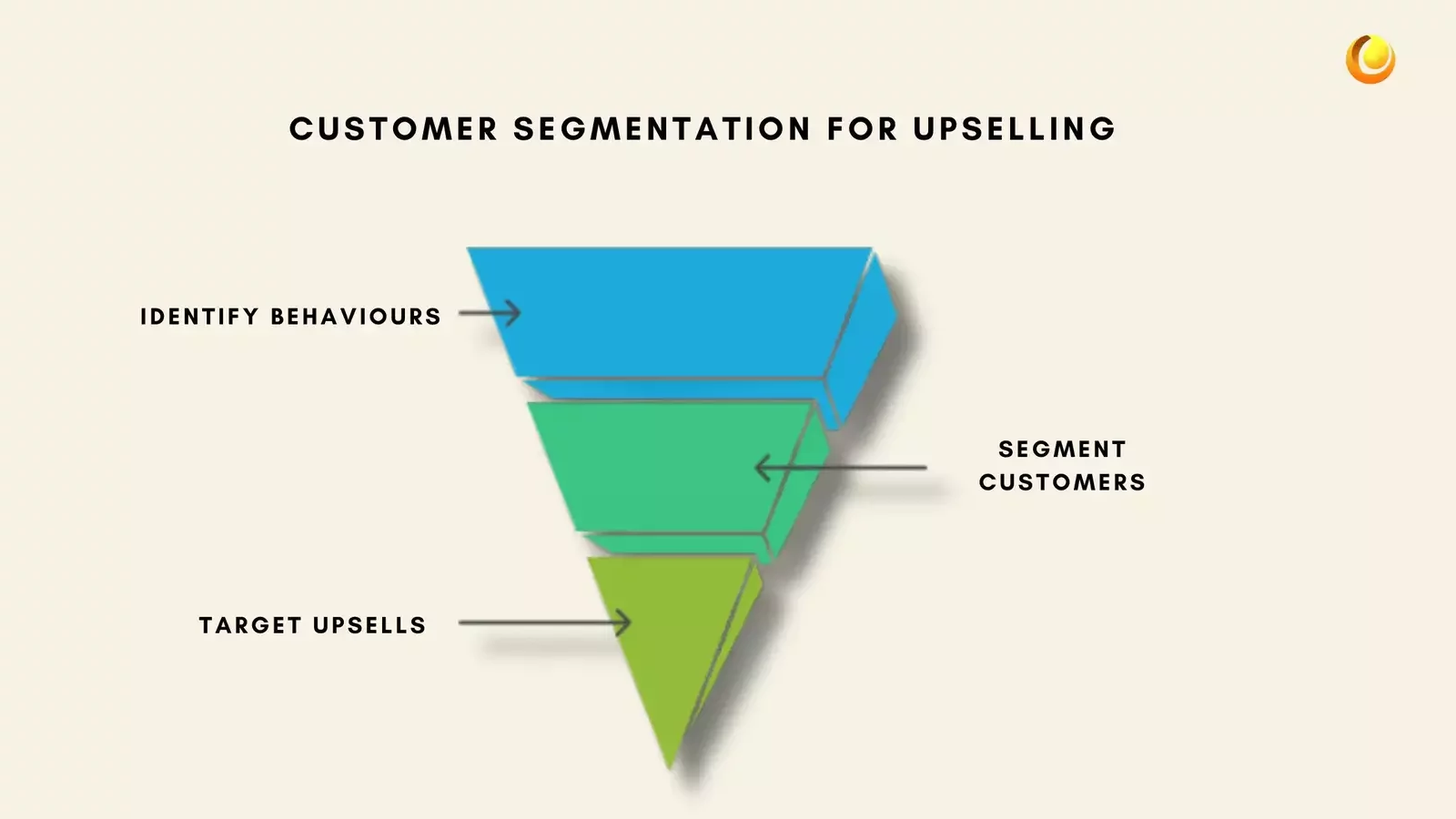

Strategy 1: Segmenting Customers for Targeted Upsells

Why It Works?

Segmenting customers isn’t just about organisation—it’s about precision. By grouping customers based on behaviours like purchase frequency or spending habits, businesses can pinpoint who’s ripe for an upsell. A customer who’s bought a basic software subscription, for example, might be ready for a premium upgrade if they’re using advanced features. This taps into a natural inclination: people buy more when offers align with their needs, boosting customer lifetime value effortlessly.

CRM in Action

Modern CRMs like HubSpot, Zoho, or Salesforce make segmentation a breeze. Using filters and tags, they automatically categorise customers based on criteria you set—say, “spent over £500 in the past six months” or “frequent buyers of Product X.” This automation saves time and ensures your marketing hits the mark.

Example: TechTools’ Success

Take TechTools, a hypothetical SaaS firm. They used their CRM to segment customers by usage patterns, spotting those on a basic plan who regularly tapped into premium features. A targeted email campaign offering a discounted upgrade led to a 20% increase in upsell conversions. While fictional, this mirrors real-world tactics—think of how UK retailers like John Lewis segment shoppers for exclusive offers Customer Segmentation Guide and Use Cases.

Log into your CRM today and create a segment like “Customers who’ve spent >£500 in the last six months.” Craft a personalised email offering a complementary product or service. Watch how this simple move lifts customer lifetime value over time.

Expanding the Strategy

Segmentation isn’t static. As your business grows, refine these groups—perhaps by region (e.g., London vs. Scotland) or industry (e.g., retail vs. tech). A Bristol-based e-commerce shop might find that local customers prefer faster delivery upsells, while online-only buyers respond to bundled deals. This adaptability ensures your CRM keeps pace with your customer base, maximising CLV at every turn.

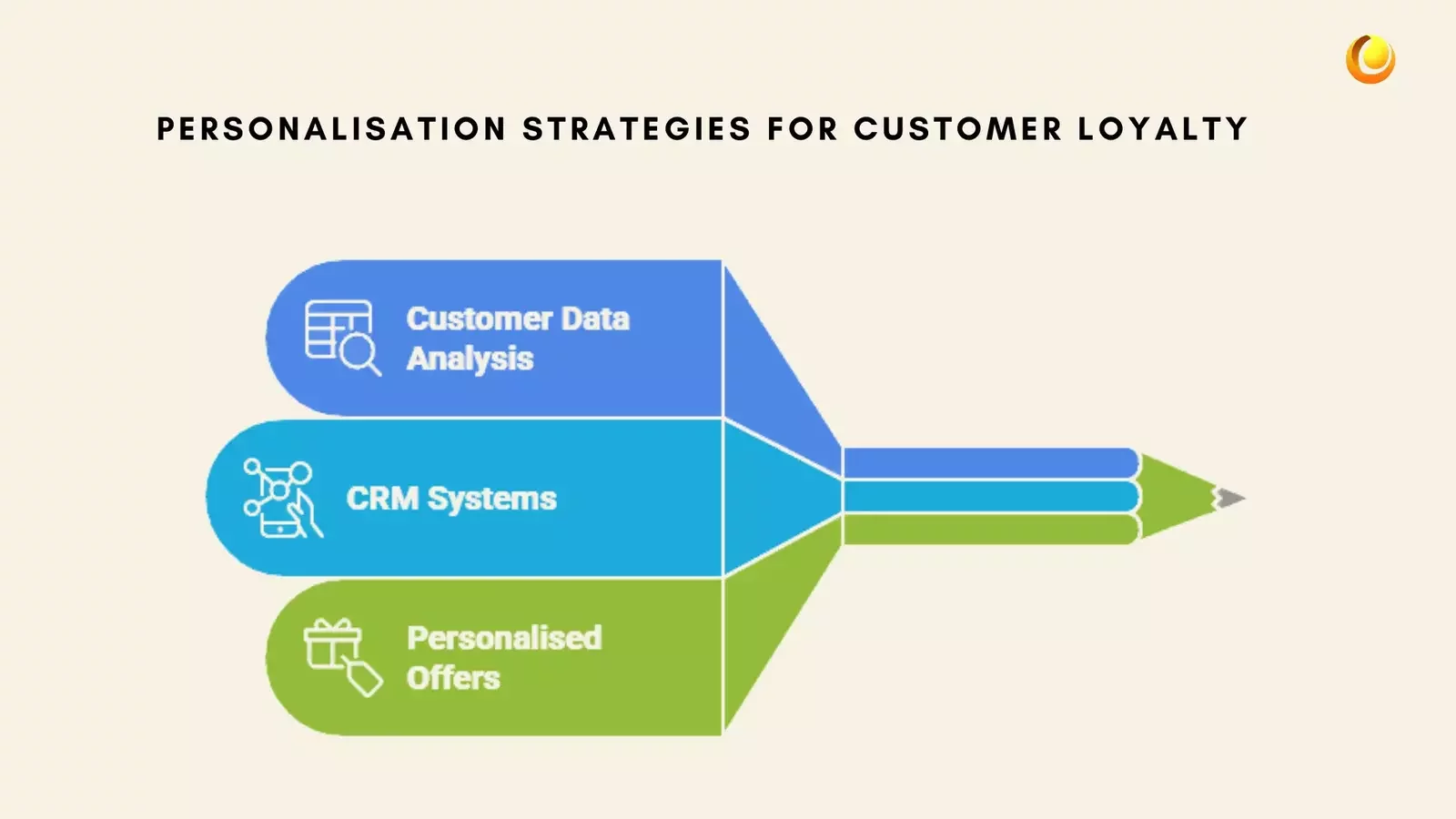

Strategy 2: Personalising Offers to Boost Repeat Purchases

Why It Works?

Personalisation isn’t a buzzword—it’s a profit driver. When customers feel understood, they’re more likely to return. Data backs this up: according to HubSpot, personalised calls-to-action outperform generic ones by 202%.

CRM in Action

CRMs excel at personalisation by tracking details like birthdays, purchase histories, or even abandoned carts. A Sheffield bakery, for instance, could use its CRM to send a “Happy Birthday” discount code, while a Brighton gym might recommend yoga classes to members who’ve bought fitness gear.

Example: The Coffee Shop Boost

Picture a fictional UK coffee chain, Brew Haven. Using their CRM, they sent personalised birthday emails offering a free latte. The result? A 15% uptick in repeat visits within a month. This aligns with trends seen in brands like Costa, where tailored offers keep customers coming back. Personalisation here directly enhances customer lifetime value by turning one-off buyers into regulars.

Set up a CRM campaign to email customers a 10% discount on their purchase anniversary. Use a tool like Mailchimp, integrated with your CRM, to automate this. It’s a small effort with a big CLV payoff.

Personalisation scales with sophistication. Start simple—names in emails boost open rates by 26%—then graduate to dynamic content. A Leeds fashion retailer could show winter coats to northern customers and lightweight jackets to southern ones, all driven by CRM data. This layered approach ensures every interaction nudges customer lifetime value higher.

Strategy 3: Predicting and Preventing Churn

Why It Works?

Churn is the silent killer of customer lifetime value. Losing a customer doesn’t just halt their current spending—it slashes their future revenue potential. Spotting at-risk customers early lets you intervene, preserving their CLV. Personalised outreach can cut churn by up to 20%, as it shows customers you care about ways you can reduce customer churn using CRM.

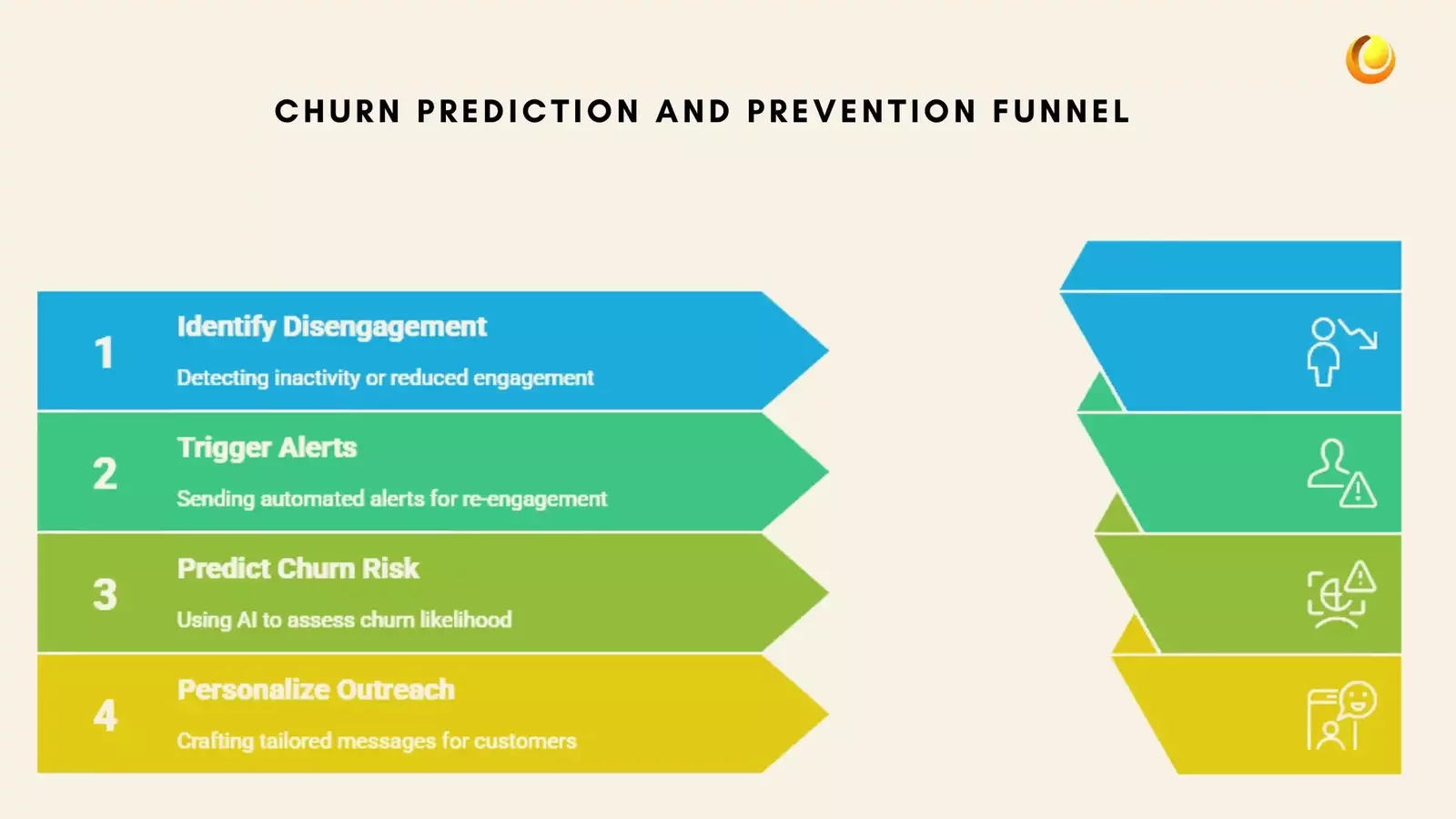

CRM in Action

CRMs like Zendesk or Pipedrive flag disengagement—think of customers who haven’t logged in for 30 days or stopped ordering. Automated alerts trigger re-engagement emails, while AI tools might even predict churn risk based on patterns, giving you a head start.

Example: SaaS Survival

Imagine a Glasgow-based SaaS firm, CloudCore. Their CRM flagged users inactive for over a month, a churn red flag. Automated “We miss you” emails with a 20% discount on renewal slashed churn by 30%. This fictional case echoes strategies from UK tech firms like Sage, where retention is kingon how to reduce customer churn.

In your CRM, set a “low engagement” alert for customers inactive for 30 days. Pair it with a re-engagement email—“We’ve missed you! Here’s 15% off your next order.” It’s a proactive step to safeguard CLV.

Churn prevention evolves with data. Use CRM analytics to spot deeper trends—perhaps customers churn after poor support experiences. A Cardiff call centre could then prioritise training, while a CRM tracks resolution times. This holistic approach ensures customer lifetime value stays intact, even amid challenges.

Strategy 4: Rewarding Loyalty to Lock In Long-Term Value

Why It Works?

Loyalty is the golden ticket to higher customer lifetime value. Rewarding repeat customers not only encourages more purchases but also extends their tenure with your brand. Loyal customers spend 67% more than new ones, making them a revenue powerhouse. Here are somecustomer retention stats, you would like to know.

CRM in Action

CRMs manage loyalty programmes seamlessly—tracking points, tiers, or rewards tied to purchase history. A Nottingham retailer could award points per pound spent, redeemable for discounts, all synced through their CRM for a smooth customer experience.

Example: Retail Rewards

Assume that a retailer, ShopSmart. Their CRM-powered loyalty programme gave points for every purchase, lifting the average CLV from $200 to $350 per customer. This mirrors successes like Tesco’s Clubcard, where rewards drive repeat business. Build customer loyalty like Starbucks + Costco.

Launch a points system in your CRM—1 point per $1 spent, redeemable at 100 points for a $10 voucher. Promote it to customers to boost CLV instantly.

Loyalty isn’t one-size-fits-all. A Liverpool gym might offer tiered perks (e.g., free sessions at gold level), while an online UK bookseller could give early access to sales. Use your CRM to test what resonates, refining rewards to maximise customer lifetime value over years, not months.

Measuring Success and Optimising Customer Lifetime Value

Key Metrics

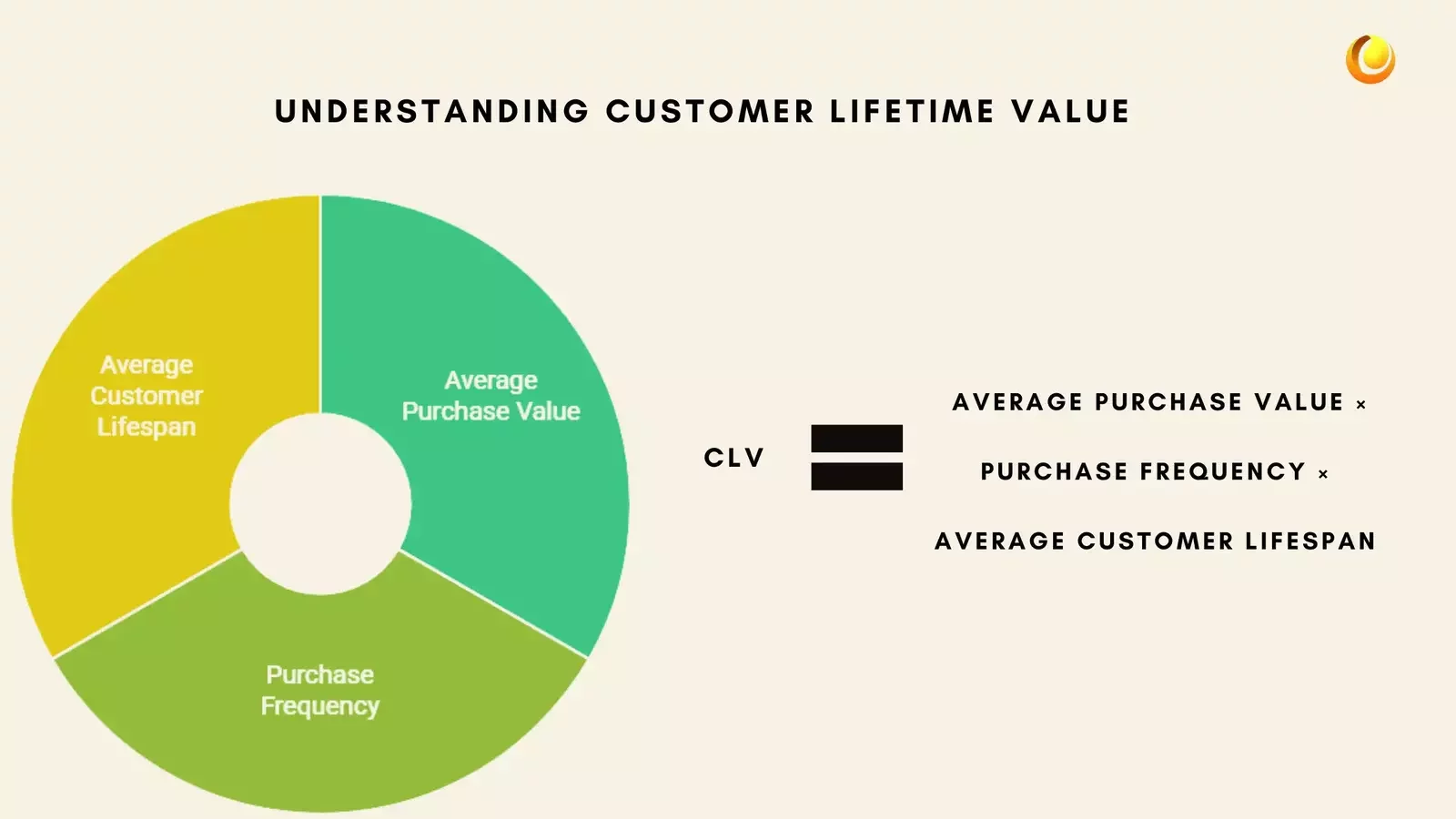

Customer lifetime value hinges on three variables:

CLV=( Average Purchase Value × Purchase Frequency × Average Customer Lifespan )

Average Purchase Value: Total revenue divided by purchases in a year.

Purchase Frequency: Purchases are divided by customer count annually.

Average Customer Lifespan: Years a customer stays active.

CRMs like Pipedrive or Zoho display these in real-time dashboards.

Iterate and Improve

Testing is key. A/B test offers—does a 10% discount beat a gift?—and use CRM insights to tweak strategies. A Southampton travel agency might find package deals lift CLV more than discounts, adjusting accordingly.

Tool Tip

Opt for a CRM with robust reporting—Pipedrive for sales-focused firms, Zoho for versatility. These tools track CLV trends, ensuring your strategies pay offCustomer Lifetime Value (CLV & LTV) Guide + Calculator.

Long-Term Optimisation

Don’t stop at initial gains. A Birmingham manufacturer could analyse CLV by product line, doubling down on high performers. Regular reviews—quarterly or biannually—keep your CRM aligned with business goals, cementing customer lifetime value as a growth driver.

The Importance of a CRM Consultant in Maximising Customer Lifetime Value

Why a Consultant Matters?

For businesses aiming to elevate customer lifetime value, implementing a CRM system can feel like navigating a maze. While the tools themselves—think Salesforce, HubSpot, or Zoho—are powerful, their full potential often remains untapped without expert guidance. This is where a CRM consultant becomes invaluable. These specialists bridge the gap between technology and strategy, ensuring your CRM aligns perfectly with your business goals, particularly in boosting CLV.

A consultant brings a wealth of experience, having worked across industries from retail in Manchester to tech startups in London. They understand the nuances of customer behaviour in the UK market—say, the preference for personalised service in the South East versus practicality in the North—and tailor your CRM accordingly. Without this expertise, businesses risk wasting time and budget on misconfigured systems that fail to enhance customer lifetime value.

How They Drive CLV?

CRM consultants excel at customisation. They’ll analyse your customer data to identify high-value segments, set up automated workflows to prevent churn and integrate loyalty programmes—all of which directly lliftsCLV. For instance, a consultant might spot that your Cardiff-based firm loses customers after 12 months due to poor follow-up. They’d then configure your CRM to trigger re-engagement emails at the 11-month mark, preserving customer lifetime value.

Moreover, they save you from costly trial-and-error. A 2025 survey by TechRadar suggests that businesses with expert CRM implementation see a 30% faster ROI compared to those going it alone [TechRadar CRM Insights 2025]. For a small business in Birmingham or a growing enterprise in Edinburgh, this accelerated return translates into quicker gains in customer lifetime value—think increased repeat purchases or extended customer lifespans.

When to Hire One?

Consider a consultant if you’re new to CRM, scaling rapidly, or not seeing the CLV uplift you expected. They’re not just for setup—ongoing support ensures your system evolves with your business. A Bristol retailer, for example, might hire a consultant to overhaul their CRM post-expansion, aligning it with a new loyalty strategy to maximise customer lifetime value across multiple locations.

Research CRM consultants with UK-specific experience—look for case studies showing CLV improvements. Schedule a consultation to assess how they can tailor your CRM to your business, ensuring every pound invested boosts customer lifetime value effectively.

Top Tips for Using CRM to Enhance Customer Lifetime Value

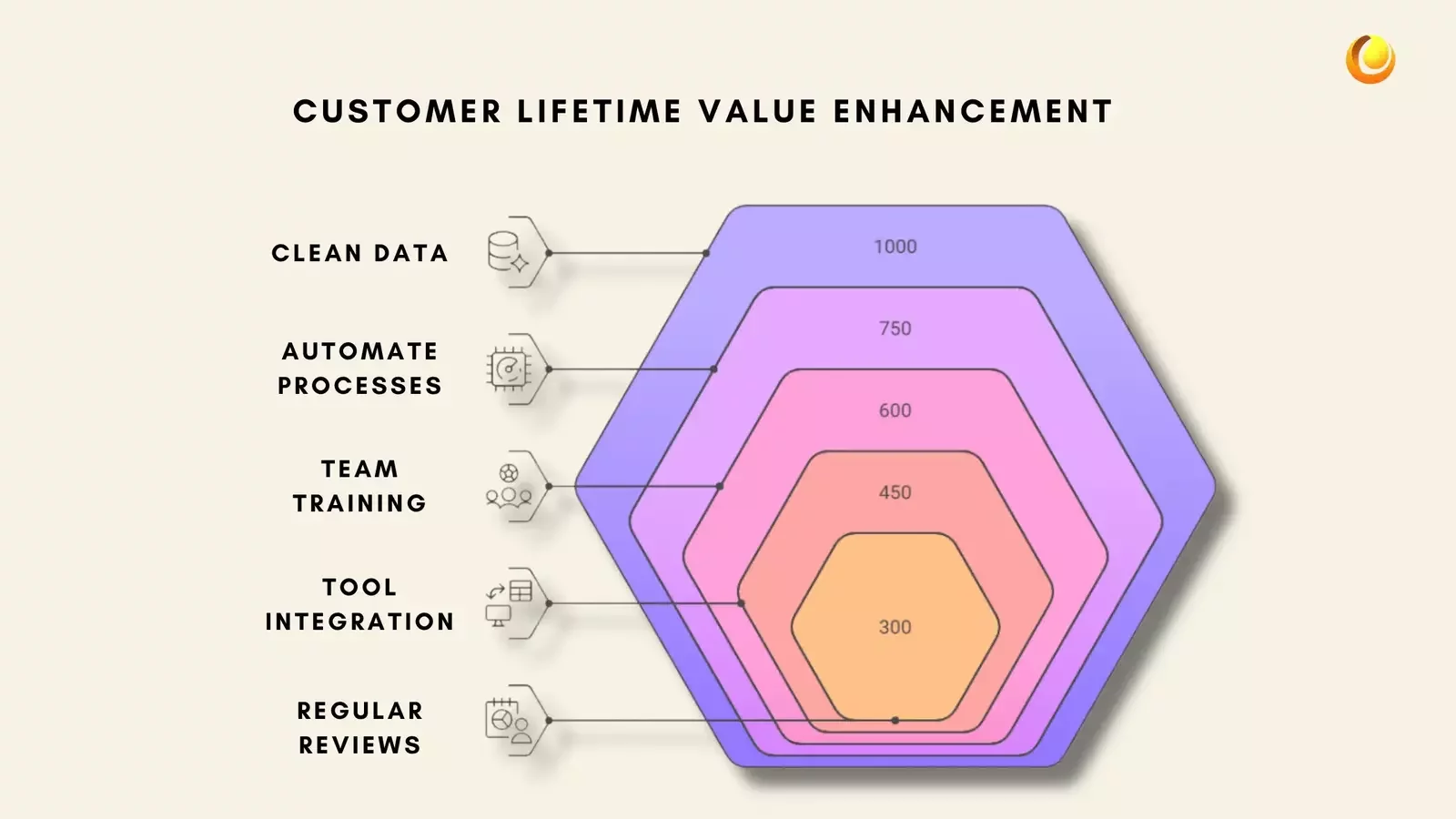

Tip 1: Start with Clean Data

Your CRM is only as good as the data it holds. Messy, outdated, or duplicate records—like multiple entries for “J. Smith” in Leeds—can derail your efforts to maximise customer lifetime value. Cleanse your database regularly: remove inactive contacts, merge duplicates, and ensure fields like email and purchase history are up-to-date. A Southampton e-commerce firm found that a 10% cleaner database lifted their email campaign response rates by 15%, directly impacting CLV through better targeting.

Tip 2: Automate Where Possible

Time is money, and manual tasks sap both. Use your CRM to automate repetitive processes—think follow-up emails, lead scoring, or loyalty point updates. A Glasgow consultancy automating client check-ins via their CRM saw significant increase in repeat contracts, enhancing customer lifetime value without extra staff hours. Automation frees your team to focus on strategy, not admin, amplifying CLV gains.

Tip 3: Train Your Team Thoroughly

A CRM’s power lies in its use, not its existence. Equip your staff—whether in sales, marketing, or support—with comprehensive training. A poorly trained team might overlook features like churn alerts, and missing chances to retain customers and boost CLV. A Nottingham manufacturer trained their staff on Zoho’s analytics tools, uncovering a CLV increase opportunity by targeting lapsed buyers. Regular workshops keep skills sharp and customer lifetime value rising.

Tip 4: Integrate with Other Tools

Siloed systems hinder CLV growth. Link your CRM with tools like email platforms (e.g., Mailchimp), accounting software (e.g., Xero), or e-commerce systems (e.g., Shopify). A Liverpool retailer syncing their CRM with Shopify saw an outstanding uptick in personalised upsell offers, driving customer lifetime value skyward. Integration creates a unified view of each customer, making every interaction count.

Tip 5: Review and Adapt Regularly

Customer needs shift—your CRM strategy should too. Schedule quarterly reviews to analyse CLV metrics and adjust tactics. Did a Birmingham café’s loyalty discount spike repeat visits? Test a higher tier. A CRM that adapts—say, adding regional preferences for Scottish customers—ensures customer lifetime value keeps climbing. Use dashboards to spot trends and act fast.

Pick one tip to implement this week—start with data cleaning or a quick automation setup. Monitor its impact on customer lifetime value over a month, then layer in the next tip. Small, consistent changes compound into big CLV wins.

Conclusion

Maximising customer lifetime value is no longer a lofty ambition—it’s a concrete strategy for businesses aiming to secure lasting success in 2025 and beyond. Whether you’re a small retailer in Amsterdam, a tech firm in Melbourne, or a consultancy in London, the four core strategies we’ve explored—segmenting customers for upsells, personalising offers, preventing churn, and rewarding loyalty—offer a clear path to transforming your customer relationships into a revenue-driving force.

Add to that the pivotal role of a CRM consultant and the practical tips for optimising your system, and you’ve got a robust toolkit to elevate customer lifetime value to new heights.

The beauty of CRM lies in its adaptability. It’s not a one-size-fits-all solution but a dynamic platform that evolves with your business. By harnessing its data-driven insights, you can turn fleeting transactions into enduring partnerships, ensuring every customer’s lifetime value contributes to your bottom line.

I hope you’ve enjoyed this post and found inspiration to supercharge your CRM efforts. Expert guidance can make all the difference if you’re ready to enhance your sales team’s effectiveness and unlock the full potential of customer lifetime value. You can work with professionals like IT Solutions Solved for expert consultation—their tailored approach ensures your CRM aligns perfectly with your goals, driving sales and CLV with precision.

Start today: pick your CRM strategy, consult with the experts, and watch your business thrive. Your CRM isn’t just a tool—it’s your gateway to a future where customer lifetime value fuels sustainable growth.